ng them just blew through $6B+ over the past five years and most are now bankrupt. The math never worked but everyone pretended it would until interest rates went up and suddenly “unit economics” mattered again.

Before we begin... a big thank you to this week’s sponsor.

Today’s Best Local Deals—Hand-Picked for You

Dinner for two that costs less than delivery? A full-service facial priced like a sheet mask? With Groupon, these aren’t fantasies—they’re today’s deals waiting for you to claim.

The team at Groupon scours your city every morning to uncover restaurants, salons, and activities you’ll love and negotiates savings of up to 70% so you don’t have to.

From quick lunch spots to white-tablecloth tasting menus, from barre classes to deep-tissue massages, you’ll find offers that match every mood and budget. Even better, you can stack deals: book date night now, schedule that haircut, and still have room in the budget for weekend zip-lining.

Your next “why-didn’t-we-do-this-sooner” moment is a click away. With Groupon, you can try more, stress less, and rediscover the city you thought you knew.

Before we get to the failures, let’s talk about the money. Because the money tells you everything.

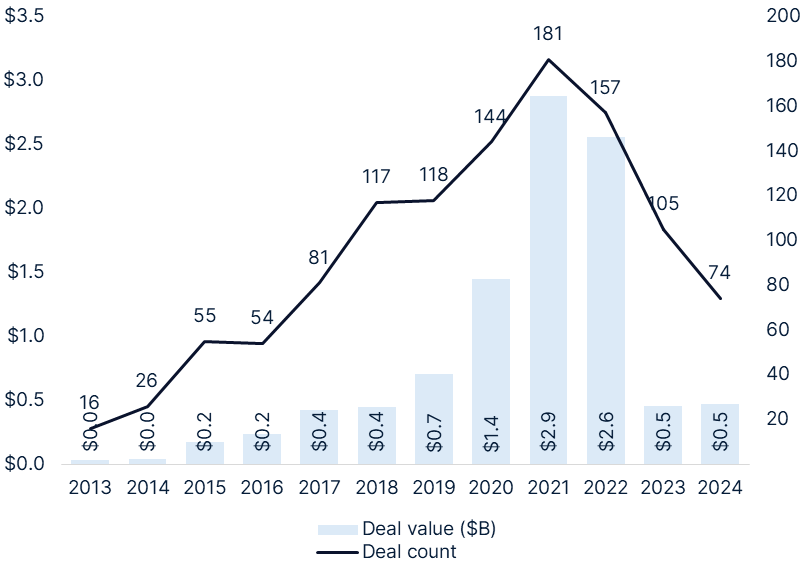

The Peak (2021): Indoor farming raised $1.6B across 70 deals. Plenty alone pulled in $400M at a $1.4B valuation.

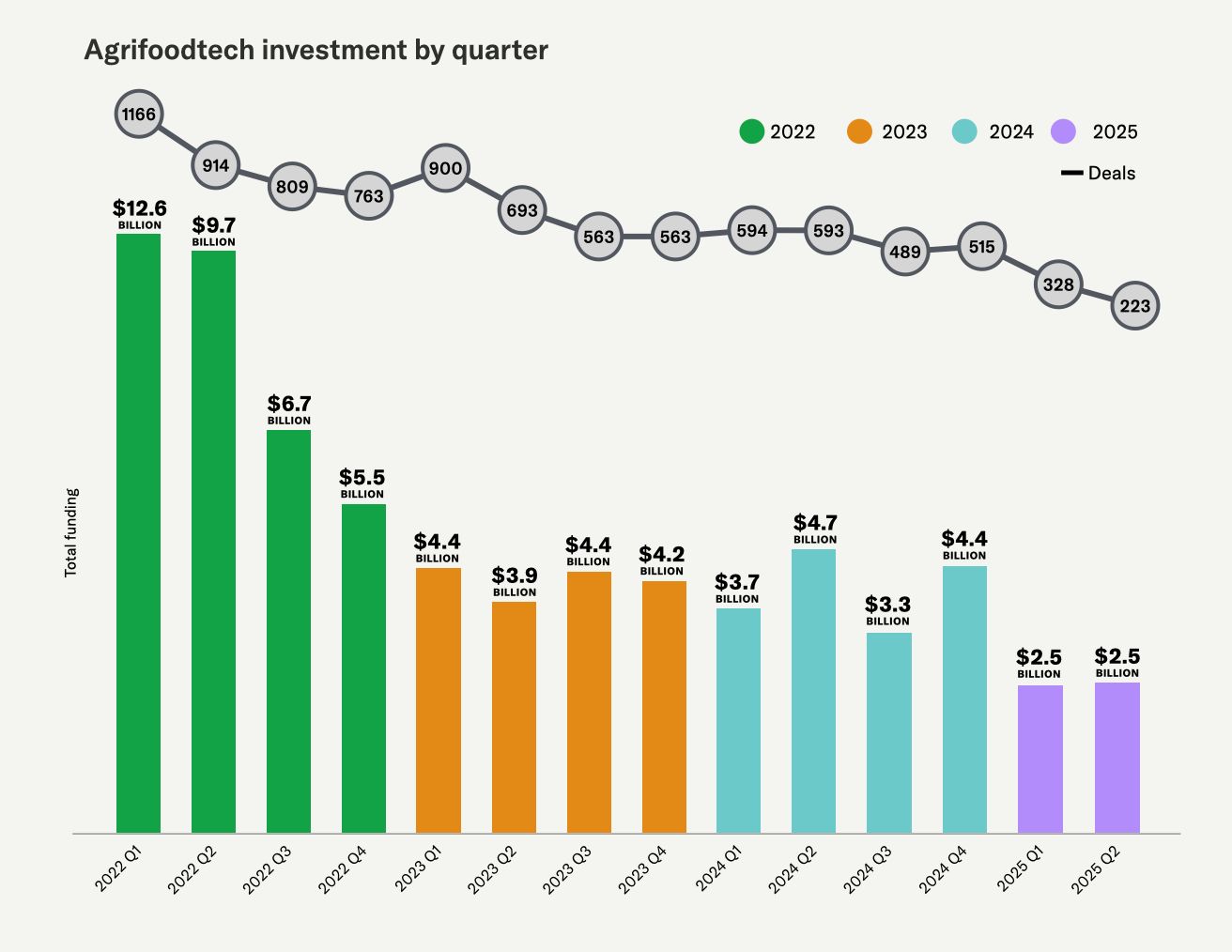

The Crash (2023): VC deal value dropped 91% year-over-year from Q1 2022 to Q1 2023. Not 50%. Not 70%. Ninety-one percent.

2024: Total agtech investment fell 25.6% with deal counts down 24.3%. Indoor farming specifically? Just $475M across 74 deals - barely a third of what they raised in 2021. At least 28 companies declared bankruptcy or ceased operations.

Q3 2024: Indoor farming pulled in only $30.1M across 11 deals. For context, that’s less than what some single companies used to raise in one round during the boom years.

VCs went from “growth at all costs” to “show me unit economics or I’m out” overnight when rates went up. The median deal size actually hit a record $3.6M in 2024, but that’s because investors are now only backing late-stage companies with proven models. Early-stage vertical farms? Dead on arrival.

Henry Gordon-Smith from Agritecture put it bluntly: “The collapse of high-profile vertical farms like Plenty, Infarm, and AeroFarms has exposed how poorly short-term, hyper-growth VC models align with an asset-heavy, margin-sensitive business like indoor farming.”

Now the business failures:

Plenty: $940M raised, backed by Bezos and SoftBank. Filed Chapter 11 in March 2025. Their Compton mega-farm? Shut down after 18 months because - shocker - energy costs were crushing them. They tried pivoting to strawberries in Virginia. Too late.

Bowery Farming: $700M+ raised, once valued at $2.3B. Dead. November 2024. Investors included GV, Fidelity, General Catalyst, plus Justin Timberlake and Natalie Portman for that celebrity sparkle. They got hit by a pathogen (phytophthora) in May 2023 that wiped out entire crops. Their integrated water systems meant it spread everywhere. By summer ‘24, even Whole Foods stopped carrying their stuff. Their spring mix was $16/pound vs $6 for the Whole Foods house brand. Do that math.

AppHarvest: $700M raised, went public via SPAC at $1B valuation. Bankrupt July 2023, owing $341M. The operation was a disaster - greenhouses hitting 125°F, workers getting hospitalized from heat, minimal training, crops rotting. They settled investor lawsuits for $4.85M. The 63-acre greenhouse in Kentucky promised jobs to Appalachia but ended up hiring migrant workers instead when local staff quit en masse.

AeroFarms: $300M+ raised, filed bankruptcy June 2023. The twist? They actually emerged from bankruptcy and are now profitable focusing on microgreens. But they had to cut everything else.

Vertical Future (UK): £37M raised, up for sale after £10M+ losses. InFarm - administration 2023. Fifth Season - shut down. Freight Farms - ceased operations April 2024 (new owners now). Kalera, Agricool, Future Crops, Glowfarms - all gone.

In Europe alone, at least 15 vertical farming companies went bust between 2020-2023.

Why This Was Always Doomed

Here’s the core issue nobody wanted to say out loud: you’re replacing free sunlight with LEDs.

The numbers are brutal:

Traditional greenhouses: 5.4 kWh per kg of produce

Vertical farms: 38.8 kWh per kg of produce

That’s a 7x difference. LED lights can eat 65-85% of your energy bill. HVAC takes another 10-20%. When you’re running 24/7 climate control because outdoor air can’t circulate, you’re bleeding cash.

At UK electricity prices in 2023 (£0.40/kWh), producing a kilogram of lettuce cost £5 in energy alone. In the US with industrial rates around $0.10/kWh, you’re still looking at $1.25 in electricity per kg. That’s before labor, facility costs, maintenance, rent, insurance, or literally anything else.

Monthly energy bills for small-to-mid operations: $10K-$20K. For larger facilities? Much worse. And when interest rates went up and VC money dried up in 2023-24, everyone suddenly cared about unit economics.

The ZIRP Era Delusion

Between 2019-2023, these companies raised money like it grew on - well, not their farms. Plenty alone pulled in $940M. Bowery hit a $2.3B valuation in 2021.

The pitch deck dream:

“We’ll use 95% less water!” (True but irrelevant when water is cheap)

“Year-round production!” (Also expensive)

“No pesticides!” (Consumers won’t pay 3x for this)

“Feeding cities of the future!” (At $16/pound salad?)

When money is free and every pitch is “we’re disrupting agriculture with AI and robotics,” you can ignore that you’re burning $50 to make $1 in revenue. The plan was always “raise more money, scale fixes everything, eventually we’ll be profitable.”

Classic growth-stage trap: they spent on expansion, automation, R&D, celebrity endorsements, fancy facilities, and PR - before proving the unit economics worked at even ONE location. AppHarvest built five facilities. Bowery built multiple farms. Plenty built that massive Compton facility.

Then 2022 hit. Interest rates went up. VCs got religion about profitability. Suddenly “burn rates” mattered.

What if the solution to muscle spasms, bladder issues, fatigue, and brain fog… Was hiding in your water?

An estimated 75 percent of Americans are chronically dehydrated. The cause can be as simple as not drinking enough water, or from taking certain medications, and consequently, your cells are unable to function properly.

NativePath’s Hydrate drink mix is made with 100% clean Ingredients, zero sugar, and high bioavailability. It includes essential minerals—like sodium, potassium, chloride, magnesium, and calcium—that are vital to many key functions in the body, along with Amino Acids to enhance muscle recovery and all 9 essential amino acids.

Restore Whole-Body Hydration with NativePath’s Hydrate.

The Automation

Everyone thought automation would save them. It didn’t.

AeroFarms bought robotics company RootAI in 2021. Bowery built their proprietary BoweryOS with AI monitoring. Plenty was supposedly the most tech-advanced operation on earth.

The problem: automation is expensive as hell to build and maintain. And it doesn’t solve your fundamental problem - that growing lettuce indoors costs way more than growing it in a field in Salinas, California. You automated your way into HIGHER costs while competing against dirt-cheap field-grown produce.

The Crop Economics

Almost everyone grew lettuce, leafy greens, and herbs. Why? Short growth cycles, high value per pound, controlled environment gives you an advantage.

But here’s the issue: these are commodity crops with razor-thin margins in the real market. Your “premium” pesticide-free baby kale competes with regular kale that costs 1/3 as much. Most consumers don’t care enough to pay your premium.

And the volumes? A traditional farm produces at massive scale. Your vertical farm can’t compete on price or volume. You’re stuck in the worst position: high costs, premium pricing that limits your market, competing against entrenched players with better economics.

One study found that producing wheat or rice in vertical farms costs 100x the market price just for lighting. Even with optimistic 2050 projections (cheap solar, expensive wheat), it still doesn’t work.

Case Study

Let’s zoom in because this one shows how operational incompetence can kill even a well-funded startup. AppHarvest went public via SPAC at a $1B valuation in February 2021. Stock jumped so high on opening day that trading got halted for volatility. Martha Stewart was on the board. The pitch: bring thousands of high-tech farming jobs to economically distressed Eastern Kentucky using a massive 63-acre greenhouse.

The reality:

Greenhouses regularly hit 125°F

Workers hospitalized from heat

“Shocking amount of turnover” per investor lawsuits

Poor training - workers said they had no idea what they were doing

Crops rotting but hidden before investor/media visits

Cut healthcare benefits to save money

Eventually turned to migrant labor despite promising jobs to Eastern Kentucky

They burned through everything, left workers angry, and the CEO blamed “lower-than-expected crop yields, higher-than-expected costs, and tightening equity markets.”

Translation: we didn’t know how to farm and ran out of money.

The Survivors

Not everyone’s dead. Some made it by being less stupid:

AeroFarms: Emerged from bankruptcy by focusing ONLY on microgreens. Cut everything else. New CEO Molly Montgomery came in skeptical, did the math, realized microgreens could actually work. Now profitable last two quarters selling at Whole Foods and Costco. They supply 70% of the retail microgreens market.

Oishii: Raised $150M Series B in 2024. Focused on premium strawberries at luxury prices. Smart crop choice - strawberries can actually command the premium these facilities require.

Plenty: Emerged from Chapter 11 in May 2025 with backing from SoftBank and One Madison. Now focused exclusively on their Virginia strawberry farm. Closed the California lettuce operation.

Gotham Greens: Still operating. Lower cost structure than competitors.

Grow Up Farms (UK): Running on 100% renewable energy, which helps the economics.

The pattern? Focus on either premium crops where consumers pay willingly, or optimize ruthlessly for cost. The middle ground of “premium lettuce at scale” killed everyone.

What We Learned (Or Should Have)

Energy is everything. If you can’t solve energy costs, you can’t solve the business. Plenty tried operating in regions with cheaper power. Still didn’t work for lettuce.

Prove unit economics at one site before scaling. This seems obvious but apparently wasn’t. Build one farm. Make it profitable. THEN build the second one.

Consumer willingness to pay is limited. Nobody’s paying 3x for pesticide-free kale except a tiny segment. Your TAM is not “everyone who eats vegetables.”

Automation doesn’t fix bad economics. It just makes your bad economics more expensive.

VC growth metrics ≠ business fundamentals. Raising big rounds at huge valuations feels good until you have to actually make money.

Climate/location matters. This tech might work in Dubai or Singapore where you can’t grow outdoors. In the US competing with California agriculture? Brutal.

Operational excellence matters more than tech. AppHarvest had all the tech. Still couldn’t stop their greenhouse from becoming an oven.

The Future (Maybe)

Is vertical farming dead? Not entirely. But the dream is.

What might work:

Microgreens/herbs - High value, fast cycles, premium product. AeroFarms proved this.

Strawberries - Oishii’s doing it. Premium product, consumers pay.

Research/genetics - Some companies pivoting to being tech/genetics plays rather than farmers.

Niche local operations - Small scale, community-focused, realistic about what they can do.

Hybrid models - Combining traditional greenhouses with some vertical elements.

What definitely doesn’t work:

Trying to feed cities with vertical farms producing commodity crops

Massive capital-intensive facilities growing lettuce

Anything that requires electricity prices to drop by 90%

The consolidation isn’t over. There are still companies out there burning cash. When the remaining VCs lose patience (and they will), expect more bodies.

Bottom Line.

$6B+ got incinerated proving that yes, you can grow lettuce in a warehouse with robots and LEDs. You just can’t make money doing it at scale against traditional agriculture.

The vertical farming bubble was a case study in:

VC groupthink

Ignoring unit economics

Confusing technology with business model

Growth theater over profitability

The ZIRP era’s worst excesses

Some of these founders genuinely believed they’d change agriculture. They worked hard, built cool tech, and had noble goals. But they were solving the wrong problem with the wrong solution at the wrong price point.

The few survivors will be niche players serving specific markets with specific crops. The revolution? Not happening.

Nature’s been optimizing this solar-powered system called “farms” for millennia. Turns out that’s hard to beat with LEDs and venture capital.

Finally. If you enjoyed the issue (or missed the newsletter) do reply. It’s motivating. If you don’t you can unsubscribe below.

See you Saturday.