Quirky was supposed to democratize invention. Anyone could submit an idea, the community would vote, and Quirky would handle everything else - design, manufacturing, marketing, distribution.

It sounded perfect. Felt revolutionary. Raised $185 million.

And it completely fell apart.

The Dream (That Actually Worked... For A Minute)

Ben Kaufman founded Quirky in 2009 when he was just 22 years old. The pitch was simple: crowdsourced invention platform where everyday people could become product designers.

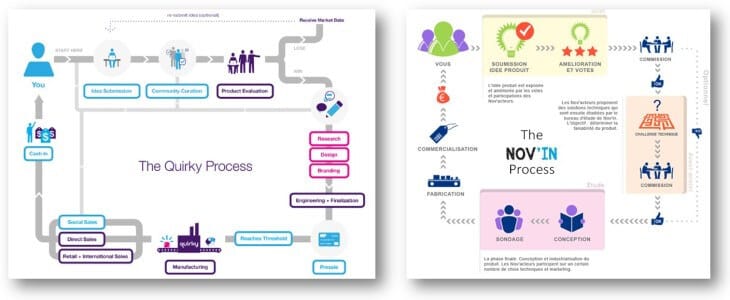

Submit your idea → Community votes → Quirky builds it → Product hits shelves → You get royalties

In April 2010, Quirky raised $6.5 million in Series A funding led by RRE Ventures.

The first hit came fast. Pivot Power, a bendable power strip idea submitted by college student Jake Zien in 2010, became a massive success - by 2015 it had generated over $2 million for Zien and other community members.

This was validation. Proof the model worked. Investors piled in.

August 2011: $16 million Series B from Norwest Venture Partners. September 2012: $68 million Series C led by Andreessen Horowitz and Kleiner Perkins. November 2013: $79 million Series D from GE and existing investors.

Total raised: $185 million (some sources say up to $200M when accounting for later bridge funding).

By 2013, Quirky had partnerships with GE, Bed Bath & Beyond, Amazon, Target. Over 500,000 community members. Thousands of weekly submissions.

They were launching products. Lots of products.

Too many products.

The Math That Didn’t Work

Here’s where the wheels came off.

Quirky’s stated goal: launch 50+ products per year.

Let that number sit for a second. Fifty. Every single year.

For context, most hardware companies consider 3-5 major product launches annually to be aggressive.

Quirky wasn’t just accelerating the innovation cycle. They were trying to run a full sprint on a treadmill set to maximum speed.

Until its shutdown, Quirky produced around 400 different products total. Four hundred. In six years.

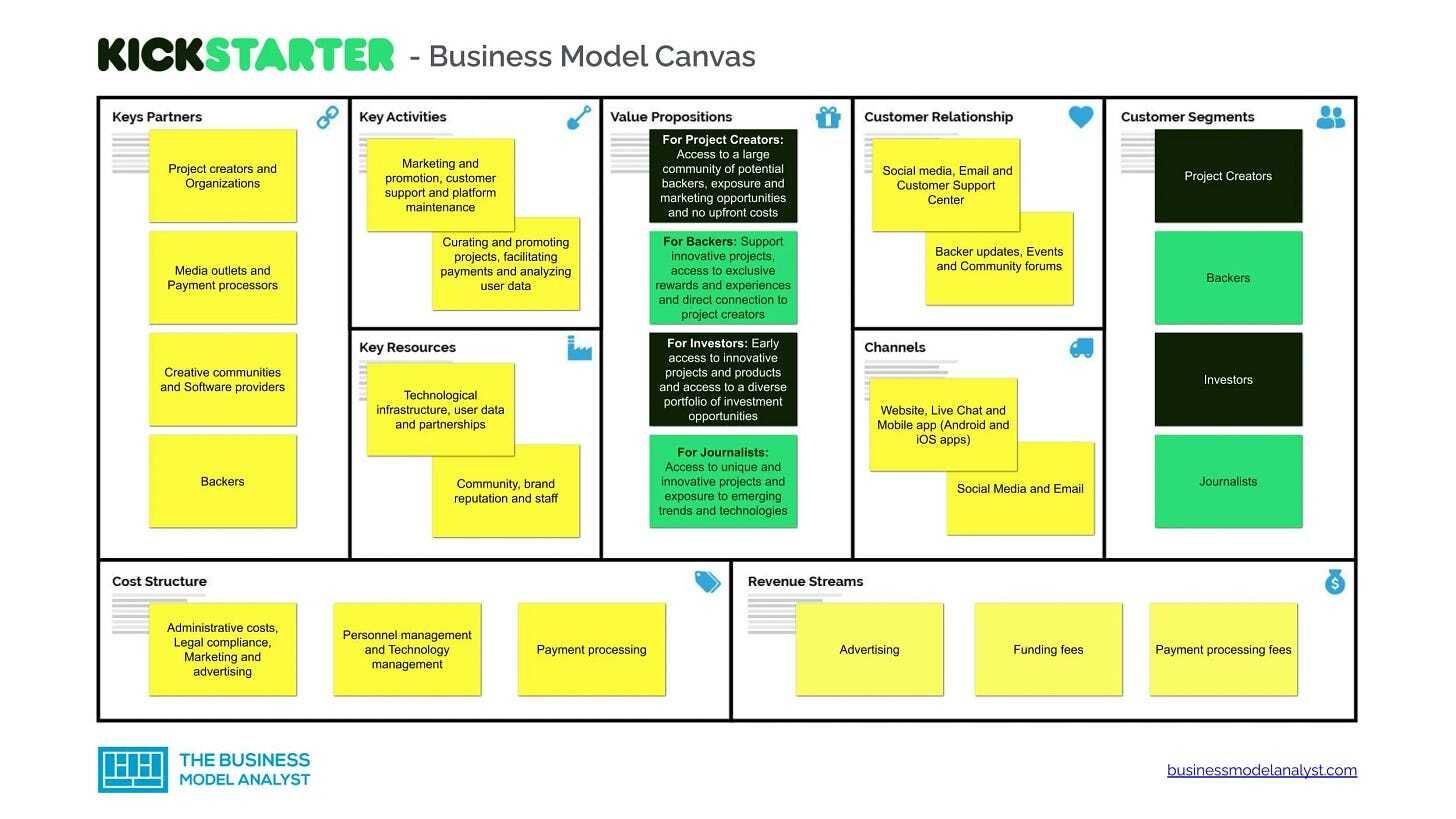

The operational overhead was insane. Because unlike Kickstarter, which shifts all risk to creators, Quirky owned the entire process:

Product design

Prototyping

Manufacturing

Quality control

Inventory management

Marketing

Distribution

Customer service

For. Every. Single. Product.

The company burned $150 million with net losses of $120 million.

When Community Votes Don’t Equal Market Demand

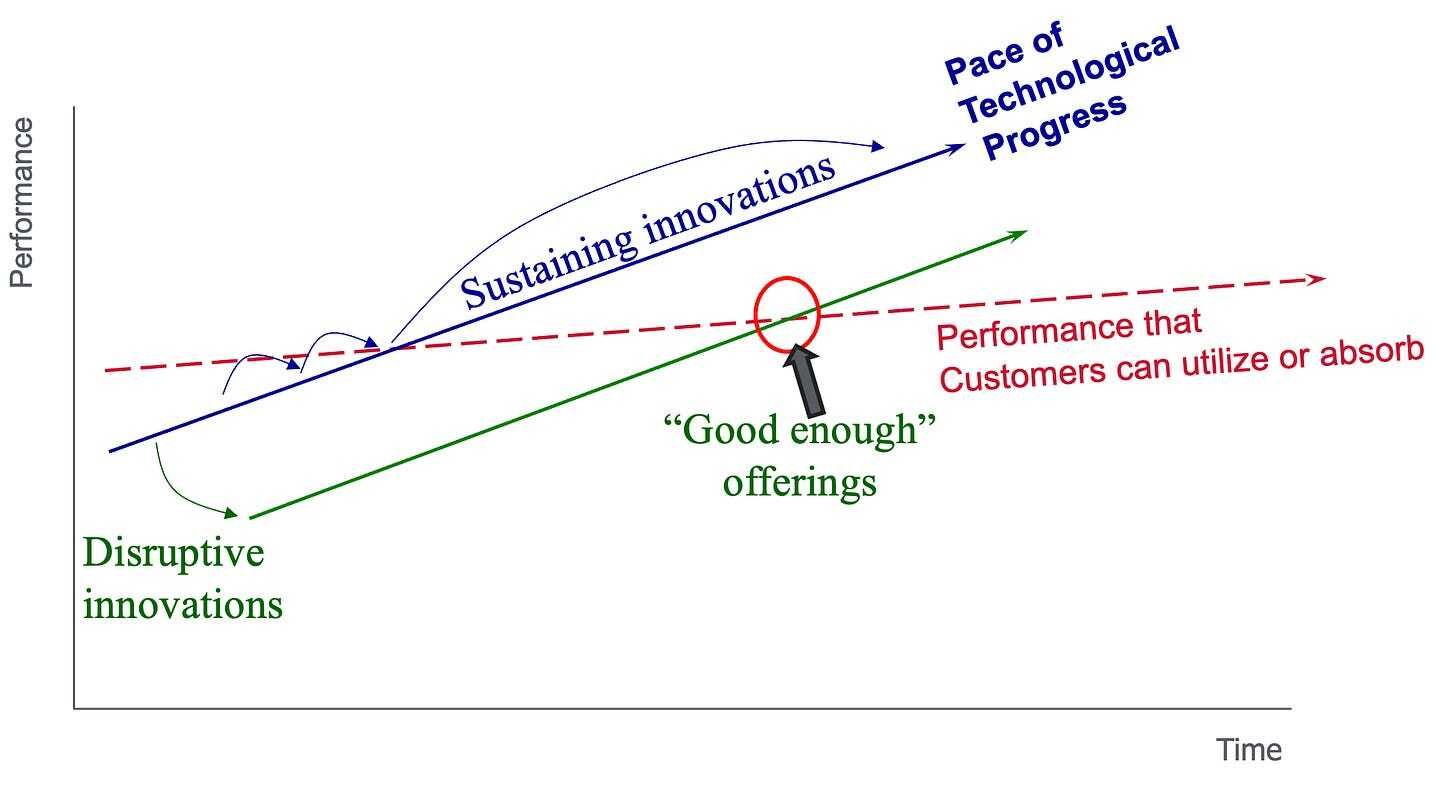

The community voting system had a fatal flaw: what people vote for and what people actually buy are very different things.

In July 2015, CEO Ben Kaufman admitted at Fortune’s Brainstorm Tech conference that Quirky “ran out of money weeks ago”.

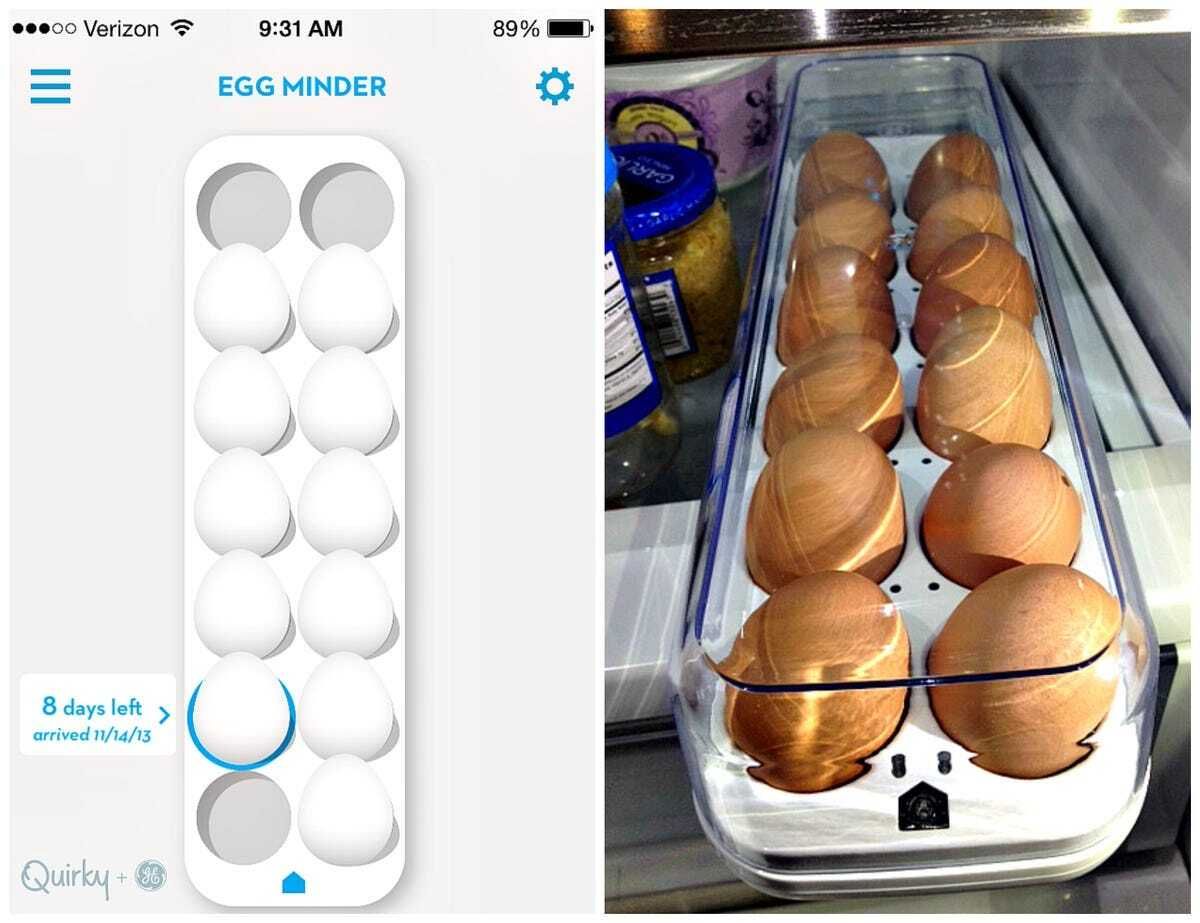

The Egg Minder became the poster child for everything wrong with the model. A smart egg tray that tracked which eggs were fresh. The community loved it. Almost nobody bought it.

Most of Quirky’s 400 products followed the same pattern. Innovative? Sure. Solving real problems people would pay to solve? Not really.

Pivot Power, their biggest hit, generated $2 million total Yahoo Sports. Across all the contributors. Over 5 years. One of their most successful products ever.

Now do that math across 400 products where 95% sold almost nothing.

The Pivot That Changed Nothing

By 2014, reality was setting in. The model wasn’t working at scale.

Kaufman tried pivoting. New strategy: become an innovation partner for big brands like Mattel, Amazon, and GE. Let them handle inventory and distribution risk while Quirky provided the crowdsourced ideas.

The logic seemed sound. Big companies have innovation problems. Quirky has an innovation platform. Match made in heaven.

Except... these companies already had innovation pipelines. They didn’t need a 22-year-old’s crowdsourcing platform to tell them what products to make.

The pivot flopped.

On July 31, 2015, Ben Kaufman stepped down as CEO following a layoff of 111 employees.

On September 22, 2015, Quirky filed for Chapter 11 bankruptcy.

The Fire Sale

Quirky’s smart home division, Wink, sold to Flextronics for $15 million. The remaining assets went to Q Holdings for about $5 million.

From $185M+ in funding to $20M in asset sales. That’s a 90% value destruction.

The math is brutal:

$185M invested

~$20M recovered

$165M evaporated

Despite the shutdown, the platform continued adding inventors at more than 100 per day, with over 25,000 submissions since 2015. People still believed in the dream.

In 2017, Quirky relaunched under new leadership with a licensing model - partnering with HSN, Shopify, and others. No more manufacturing. Just idea licensing.

It never regained momentum. The brand quietly faded.

What Actually Went Wrong

1. The speed trap

Fifty products a year sounds impressive in a pitch deck. In reality, it’s organizational suicide for a hardware company.

Every product needs:

Market research

Design iteration

Manufacturing setup

Quality testing

Marketing strategy

Distribution channels

You can’t do that well 50 times a year with 300 employees. You end up doing it poorly 50 times a year.

2. Democracy doesn’t equal demand

Community voting is great for engagement. Terrible for product-market fit.

The Egg Minder got voted through because it was clever and quirky (pun intended). But “clever” doesn’t drive purchase decisions. “I need this to solve a real problem” does.

Kickstarter figured this out: let creators pitch, let backers fund with real money. Money is the ultimate vote.

Quirky’s votes were free. Free votes don’t predict buyer behavior.

3. Owning too much of the value chain

Kickstarter: 5% fee, zero inventory risk Quirky: 100% of manufacturing, inventory, marketing, distribution costs

One model scales. The other burns $150 million.

The Real Lessons

Validate with money, not votes

Ideas are cheap. Manufacturing is expensive. If you’re going to invest millions in production, make sure people will actually pay for it first.

Focus beats variety

Quirky tried to be everything: kitchen gadgets, smart home devices, office accessories, pet products. They had no brand identity because they stood for nothing specific.

Apple launched the iPod and didn’t diversify for years. Then the iPhone. Then the iPad. One category at a time, done excellently.

Quirky launched 50 products per year across every category. None done excellently.

Speed without quality is just expensive failure

“Move fast and break things” works for software. You can ship bugs and patch them.

Hardware is different. A broken egg tracker doesn’t get a software update. It gets returned, creates customer support costs, damages brand reputation, and sits in inventory.

Despite this foundation, Quirky didn’t sell enough products and burned through $185 million in venture capital before filing for bankruptcy 6 years after opening.

Six years. $185 million. 400 products. Bankruptcy.